Financial Services

RE-PLATFORMING FOR DIGITAL BUSINESS

A large leading global financial services organisation in the midst of a global business transformation needed to replace the core applications and supporting platform underpinning their whole multi-channel operation and driving their business growth. It had shortlisted solution vendors but was concerned its RFP didn't truly reflect its strategic digital business transformation objectives and was uncertain of the robustness of the tender responses.

Result - Xaeus Blue worked closely with the key stakeholders helping them to clarify and clearly articulate their differentiating digital business aspirations and needs as well as gain a more objective and incisive assessment of the shortlisted solution vendor tender responses. With the platform and application-set choice now made, the organisation is now able to simplify its existing product set whilst in parallel launch fresh new and innovative consumer products and services to the global marketplace at least 10 times faster than was previously possible within the organisation. The deeper integrated digital capabilities enable new ways to engage with customers and more objective ways of measuring marketing effectiveness utilising new performance marketing tools.

Travel

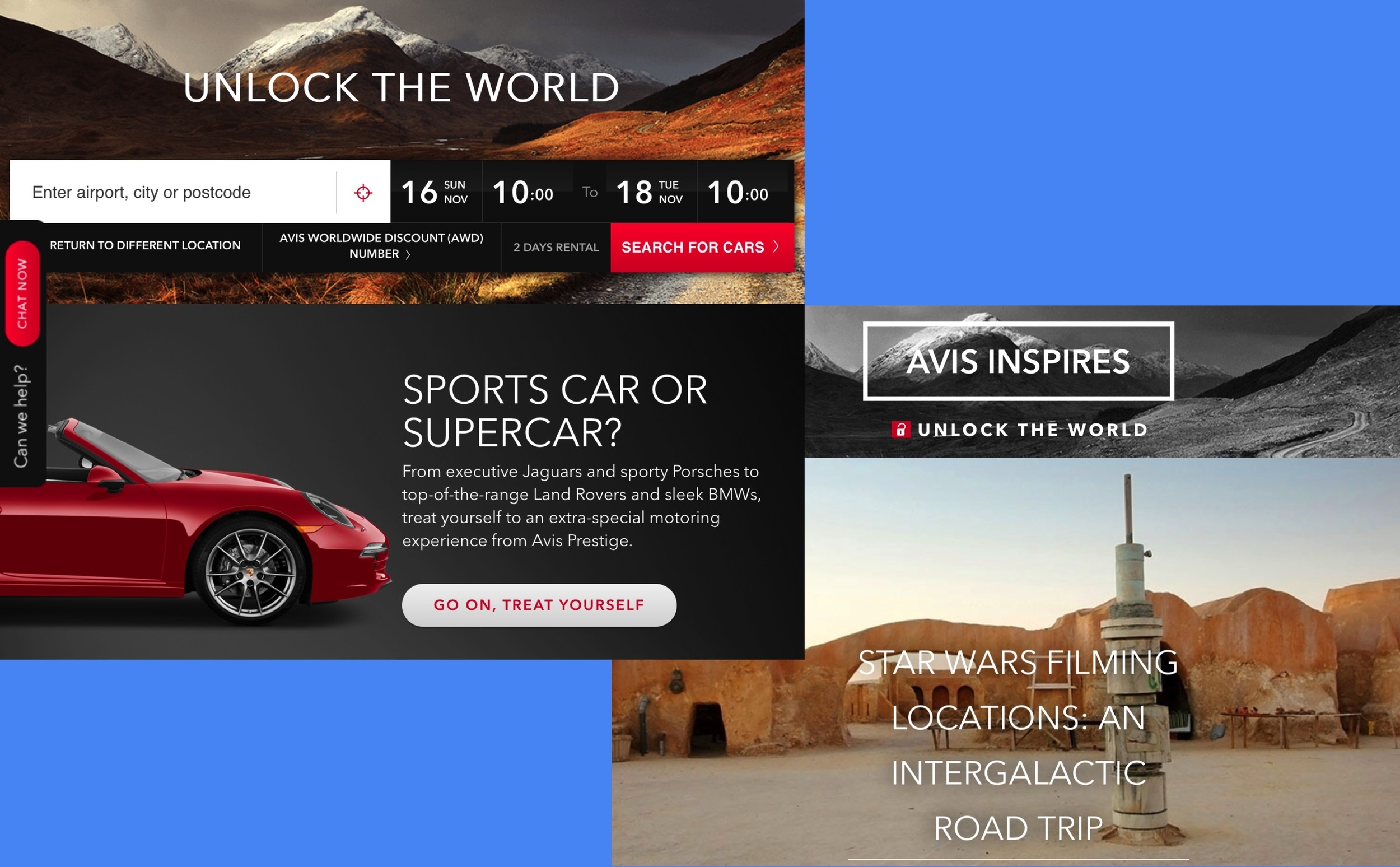

MULTI-BRAND DIGITAL TRANSFORMATION ACROSS EMEA

After Avis Budget in the US acquired Avis Budget Group in EMEA, a major EMEA-wide transformation was kicked off with Digital identified as an opportunity for significant commercial and customer service improvement.

Result - Xaeus Blue helped to define the new EMEA digital and e-commerce strategy, formulate the end-to-end digital transformation programme, deliver the new EMEA multi-brand digital platform for rapid innovation and competitive differentiation and provide hands-on interim executive management support (as group digital director). Customers were provided with a reimagined brand and user experience not normally associated with a car rental firm. In parallel, the brands experienced a significant uplift in online sales conversion of 250% above the target percentage improvement.

Technology

ENTERPRISE SOFTWARE FIRM DUE DILIGENCE

A leading investment firm asked Xaeus Blue to assist with assessing a niche digital enterprise software products company in a global fast moving highly fragmented and highly profitable market sector they were considering investing in.

Result - Xaeus Blue made recommendations to address technology and cross-functional shortfalls translating to a sales lifecycle reduction of 30-40% and product development time reduction of 40-60%. These recommendations included unexplored but immediately accessible market opportunities with potential incremental revenue equating to 20-30% of initial forecast sales. Xaeus Blue also provided an incisive up-to-date and detailed market assessment, realistic competitive market definition and assessment together with a considered market evolution roadmap. This was in marked contrast to the more generic and sparse view of the composite market, competitive space and future trends provided by reports purchased from multiple recognised global market research firms.

Retail

DIGITAL BUSINESS COMMERCIAL PERFORMANCE

A leading global retailer had a significant long-standing and un-explained discrepancy in digital channel commercial performance and effectiveness across its North American and European businesses.

Xaeus Blue conducted an investigation involving quantitative and qualitative analysis of the digital customer experience, commercial, merchandising, operational and technology considerations.

Result - Xaeus Blue delivered a validated assessment of the root causes of the decade-long discrepancy with a structured benchmarked view of their digital business commercial performance compared to leading retailers across multiple sectors. Group executive were provided with specific cross-functional areas for focus and remediation.

Digital Agency / Professional Services

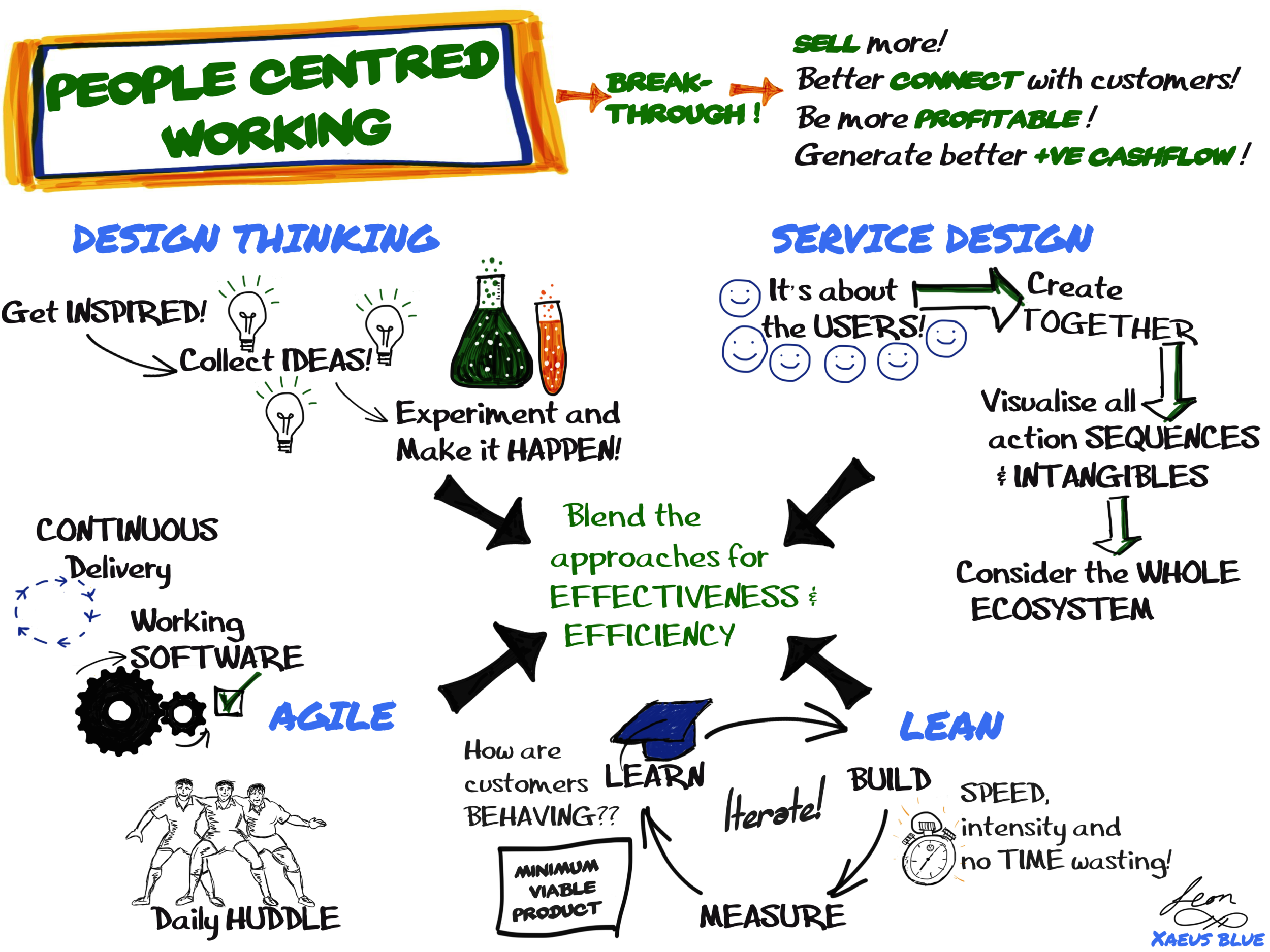

TRANSFORMING THE DIGITAL TRANSFORMERS

The European arm of this large global digital agency and IT professional services firm that serves multiple sectors across Europe/UK was grappling with how best to transform its Digital division. It wished to re-invent itself needing a solid vision, foundations and strategy to becoming the leading European digital innovator whilst enabling highly accelerated digital services revenue growth.

Result - Xaeus Blue worked closely and quickly with the European CEO and their team to facilitate definition of a compelling shared vision and a coherent actionable strategy tightly aligned to this vision. This included facilitating the definition of compelling new client services for creating transformative bespoke Digital Commerce, Marketing and Operations solutions. This was coupled with a practical approach for quickly bridging internal capability gaps particularly around advanced analytics, hyper-immersive experiences (VR), adaptive connected spaces (Internet of Things/IoT), emerging user centred design techniques, scaled lean-agile delivery, go-to-market strategy and organisational structure. Xaeus Blue's recommendations included radical changes to measuring and managing success based on service-profit chain concepts together with client bid lifecycle optimisation conservatively estimated at increasing client bid win rates by 50-70%.

Healthcare

CONNECTING HOSPITALS, HEALTHCARE PROVIDERS, SPECIALISTS AND PATIENTS

A London-headquartered venture capital firm wished to better understand the investment opportunity with a healthcare technology venture. The target business provided a cloud (SaaS) based medical information exchange service that enables interchange of medical data amongst relevant stakeholders including care givers, hospitals, healthcare providers, specialists, radiologists and health insurance providers including remote patient monitoring and the ability to integrate screening devices. The service was live and running on a global basis across a number of countries and healthcare organisations. Core to the business was a globally distributed R&D team using advanced patented data management, delivery and encryption technology it had developed particularly for managing medical imaging data.

The VC firm engaged Xaeus Blue who worked with the target business executive leadership to carry out due diligence on the technology, product and competitive market facets of the business.

Result - The observations and recommendations made by Xaeus Blue included specific product, feature, usability, technology, integration, security, performance, development process, operational, org structure, regulatory and competitive space considerations. This enabled the VC firm to better shape and focus its strategic investment approach and provided the business venture with specific improvement areas to radically improve usability, user productivity and service platform scalability whilst dropping its operating costs by 30% .

Fintech

ADVANCED PATENTED FINTECH TECHNOLOGY

A global venture capital and investment advisory firm had a unique opportunity within Fintech, one of its primary focal sectors. The technology and platform provided by the UK-headquartered fintech player was already in use by a number of leading multi-national organisations taking advantage of the tech/platform market leading capabilities and high performance. The VC firm wanted to look more closely at the fintech technology, products, processes, team and competitive space. The fintech company in turn was seeking the VC's support to build up and mature its development capability, to push into new market sub-segments and expand its international activities.

The mandate for Xaeus Blue was technology, product and market due diligence on the fintech organisation. Xaeus Blue worked closely with the VC and the fintech senior executive team paying particular attention to the advanced patented fintech technology at the core of the business as well as the team, org structure, infrastructure and processes supporting it.

Result - Xaeus Blue gave the VC firm the further clarity and insights it required regarding the fintech company as well as advising on significantly broader application and innovation with the technology within and outside financial services.

Investment Management

THE INTERNET OF THINGS (IoT) - INVESTING IN SMART HOME/PROPERTY AUTOMATION AND HEALTHCARE MONITORING

A leading global small and mid-cap investment management firm had numerous investment options within the Internet of Things (IoT) space, particularly around smart/intelligent home automation, property/building automation and remote healthcare monitoring. They needed help with better understanding these areas, the technology, the related markets, market opportunity, risks/pitfalls, how they could best support such business ventures and practical objective ways for evaluating and narrowing down the field to the best options to back.

Result - Xaeus Blue assisted the investment management team providing them the understanding they required coupled with advice around the investment strategy including acquisition/investment options, preferred technology and innovation hotspots/hubs around the world to target, global and regional market entry strategy, product strategy, channels to market and product / offering bundling through partner organisations. Xaeus Blue also recommended preferred profiles around underpinning technology, technical standards, architecture, product lifecycle, product quality attributes, culture, design and engineering mindset, scalability, security and compliance.